That’s the takeaway from last Thursday’s Jackson County Board of Equalization meeting in which the board chose to take no action on rectifying the unbelievable hot mess that is the 2019 county assessment process that levied astronomical property tax increases for thousands of Jackson Countians, mostly in poorer neighborhoods.

As this taxpaying News-Dog has noted on repeated occasions, this is taxation without representation, pure and simple, and it all comes back to roost at the feet of the county executive, his “Royal” Majesty Frank White, who refuses to admit the county’s process for property tax assessment is severely flawed, grossly unfair, and needs to be stopped in its tracks.

Thanks to the Hispanic Economic Development Corporation and Josh Myers of Valuations Solutions, this NewsDog can point to direct, factual data to prove King Frank wrong and help trigger a reset to the whole process.

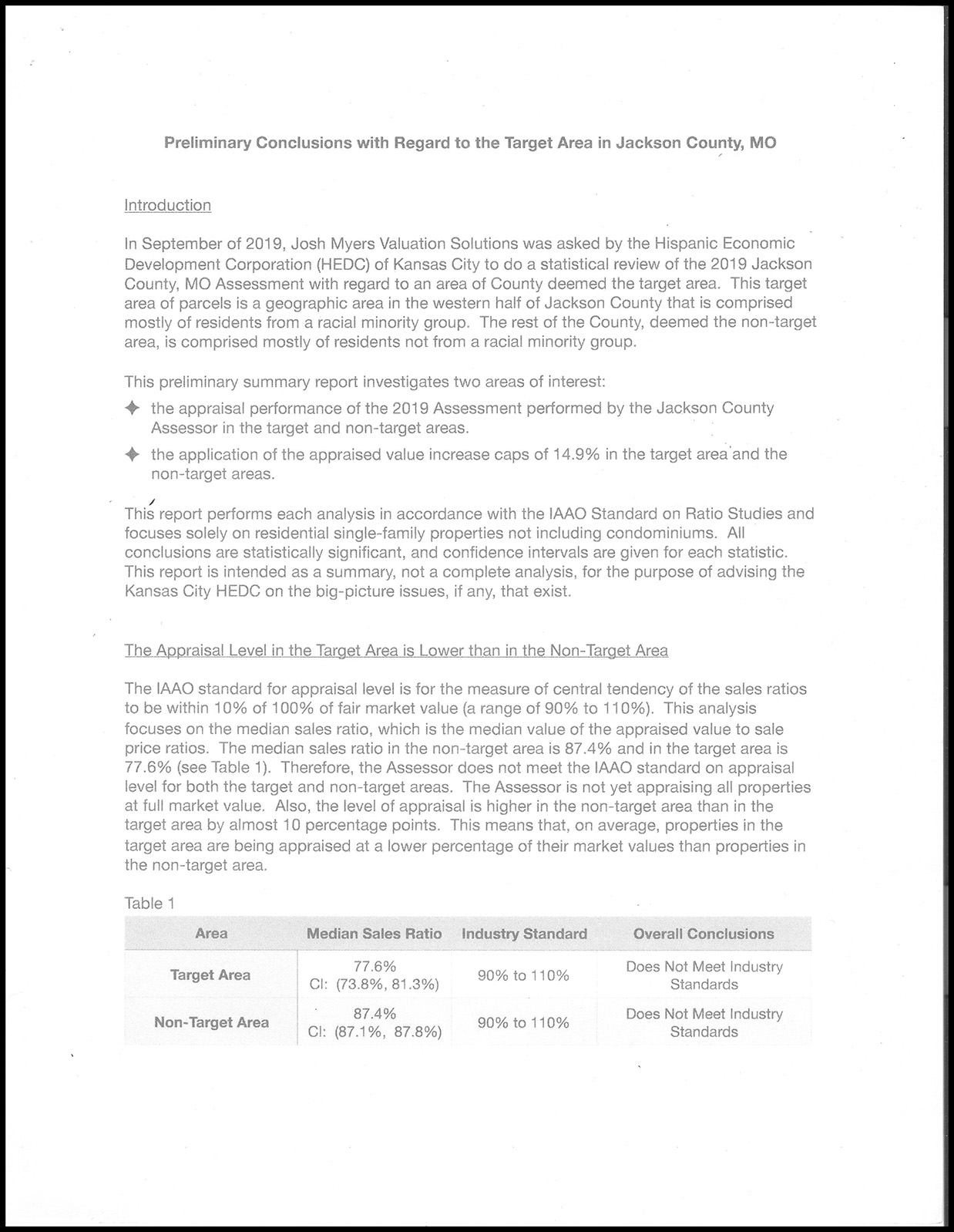

The Dog can go into the micro detail on the data but suffice it to say, it’s the same data that local legal-eagle Brandon Mason with Legal Aid of Western Missouri presented at the BOE meeting last Thursday in regard to the areas that actually saw their tax increases capped at 14.9 percent and the areas that didn’t.

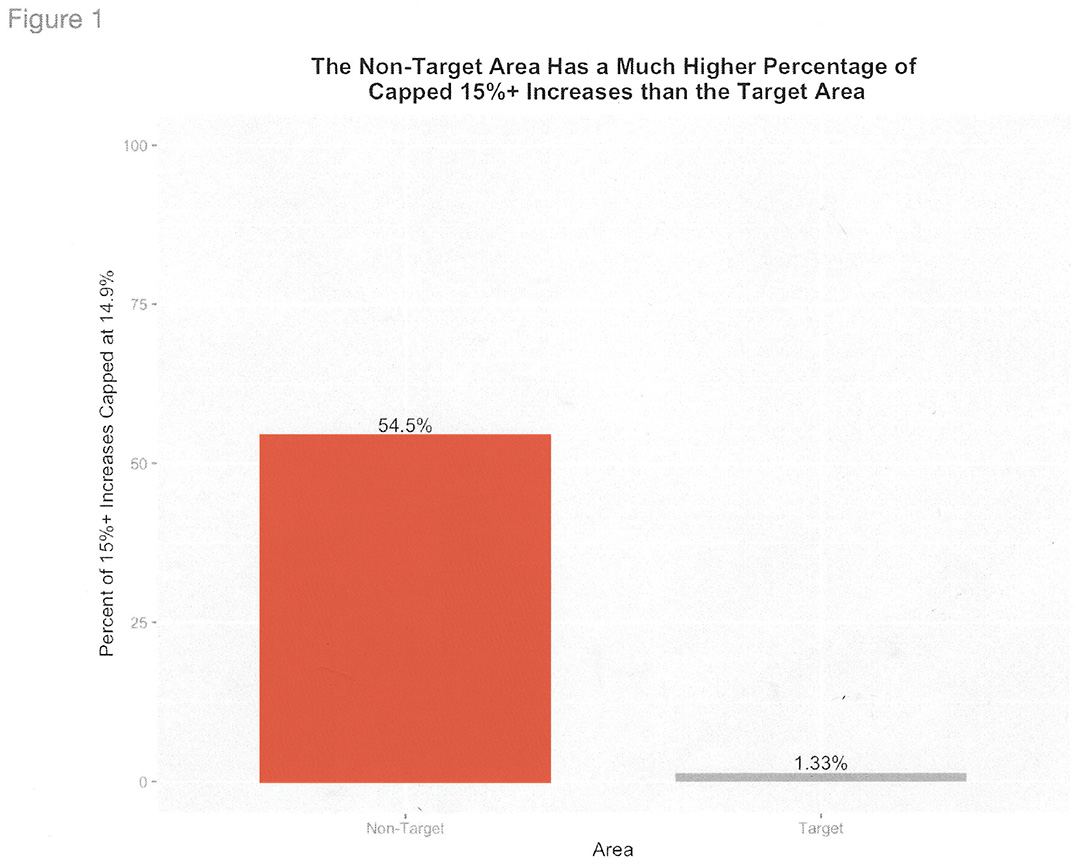

Statistics don’t lie and here’s the graphic to prove this Dog’s point.

According to the HEDC and Valuations Solutions data, in the non-target area west of Troost, 54.5 percent of properties had their property tax increase capped at 14.9 percent, while areas East of Troost, only 1.33 percent of properties had their property tax increase capped at 14.9 percent.

Those with a 14.9 percent increase in their tax bill are supposed to be happy, but given the alternative, it beats 286 percent, which is what this NewsDog was hit with.

What does this tell us? Roughly 55 percent of the properties in mostly white, more gentrified, and affluent neighborhoods had the luxury of a “measly” 14.9 percent tax increase.

Meanwhile, poorer neighborhoods, often with a higher percentage of refugees and immigrants who typically have the lowest percentage of discretionary income, are forced to bear property tax increases of 200, 300, sometimes over 700% percent.

City Hall politicos like to make a lot of hay about bringing quality residential and commercial redevelopment projects to the city’s East side, but if the tax burden is unfairly placed on the city’s poorer communities, how is this attractive for investors and low-income workers to achieve the American dream?

How does that two-income immigrant family upgrade from a rental property to a home where equity can be built?

The short answer is they can’t, and the county couldn’t give two hoots about who they displace.

This tax increase officially puts the American dream out of reach for people in neighborhoods east of Troost.

Additionally, the county’s flawed process kick starts the vacant structure cycle over the next twenty-four months.

Low-income taxpayers who can’t manage the huge increase in the county tax burden will begin to default on their taxes and mortgages over the next couple of years and ultimately walk away from their properties leaving a yet another vacant house or commercial property in the city’s urban core.

What was once a young family or small business person on the way to prosperity is now the new homeless family forced into the street at the hands of a county executive that won’t admit the reassessment process is flawed beyond recognition and needs to be stopped.

The data doesn’t lie. West of Troost, you’re the apple of the county’s taxing eye. East of Troost, pay up, sucka!

This Dog sincerely hopes that new County Administrator Troy Schulte, who brings his years of experience forging partnerships to achieve successes for the city of Kansas City, can maybe talk some sense into “Royal” King Frank and give thousands of county taxpayers desperately tax relief.