Michael Bushnell

Northeast News

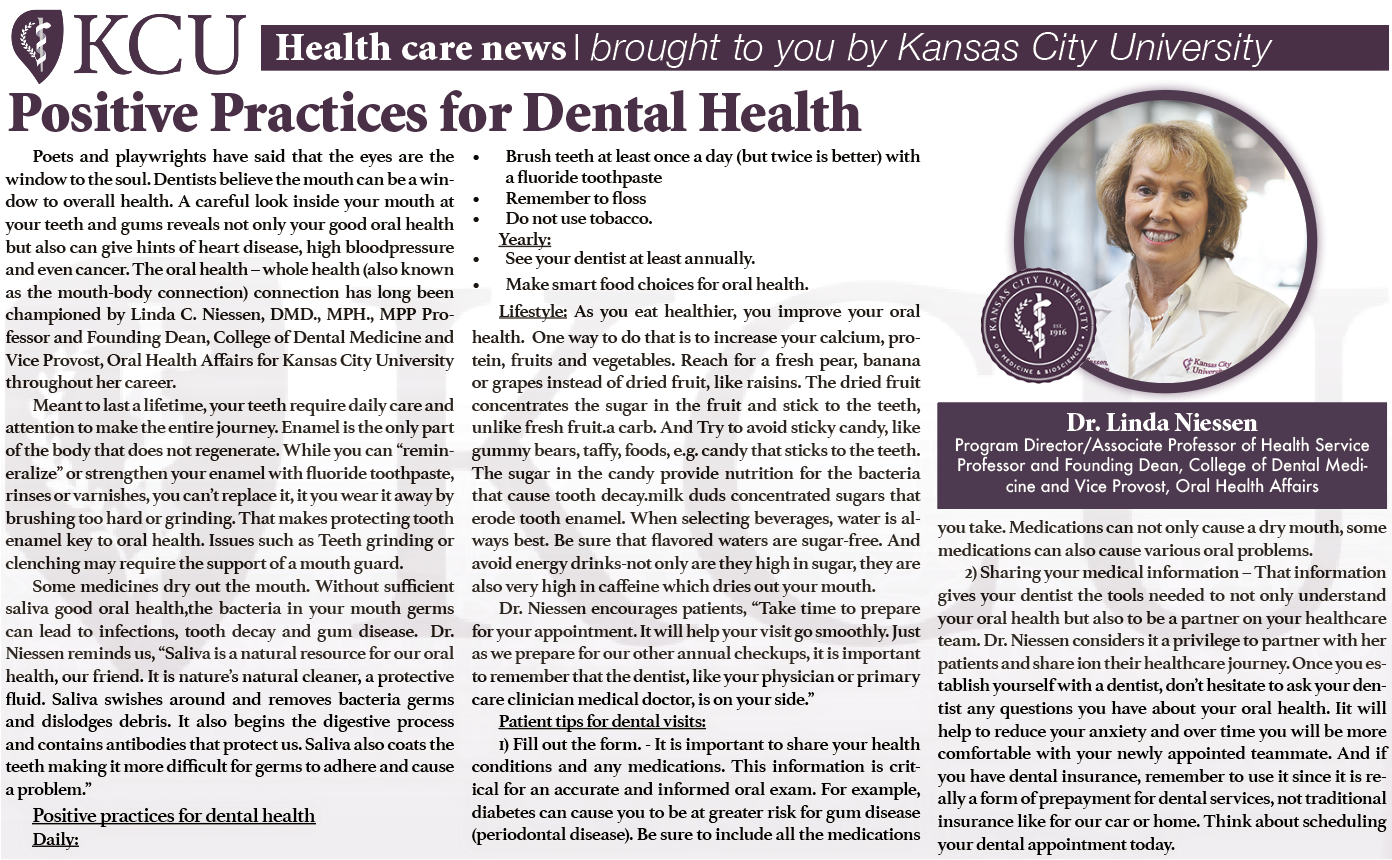

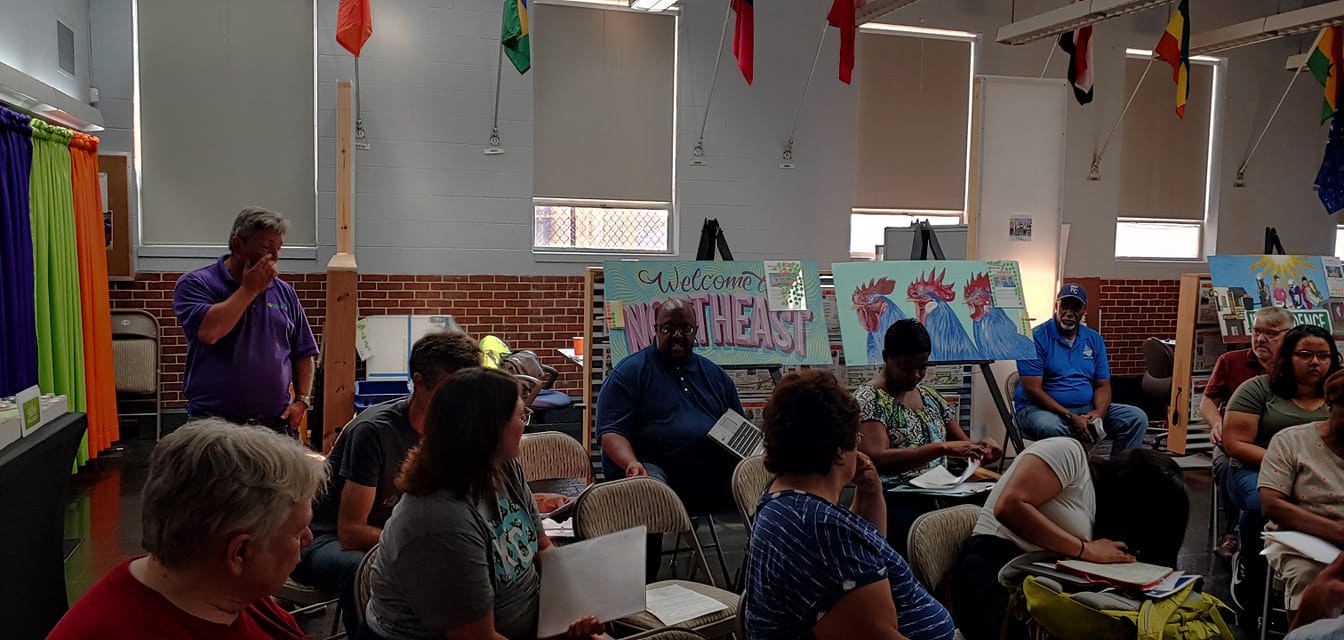

A standing-room-only crowd packed the Northeast Kansas City Chamber of Commerce offices Wednesday night, June 19.

A seminar sponsored by the Lykins Neighborhood Association coached area property owners on how to appeal the sometimes triple and quadruple digit increases in property assessments recently mailed out by the Jackson County Assessor’s Office.

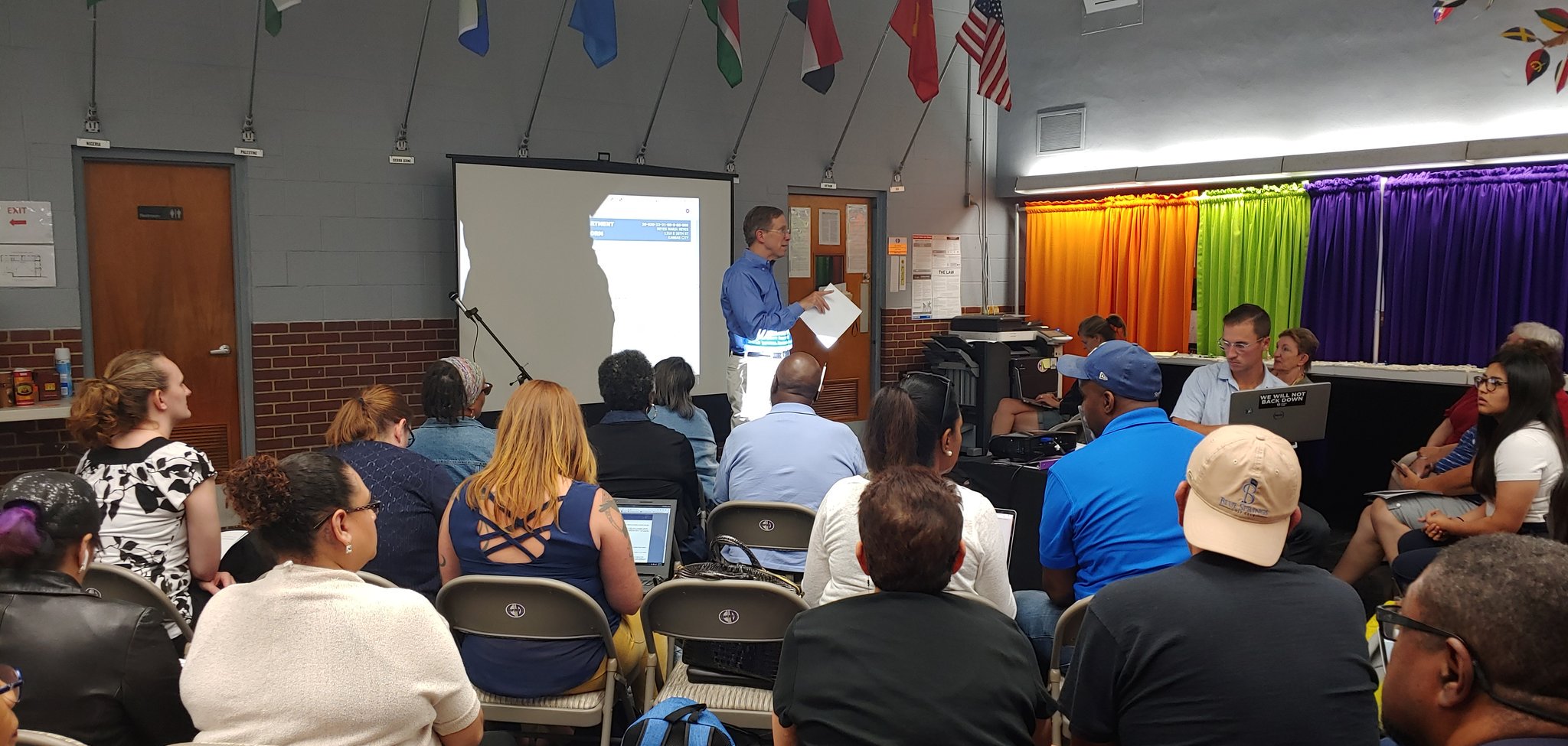

The seminar was led by former Legal Aid attorney and interim executive director of the Lykins Neighborhood Council, Gregg Lombardi, who advised residents to not use the call inline noted on the recent letter, but to file the informal appeal as well as the Board of Equalization appeal using the county’s website.

“I can tell you that the county assessment is too busy to answer that phone,” he said.

Lombardi took questions and walked people through the appeals process on-site and offered insight on how to complete the forms necessary in both the informal appeal process as well as the formal process that is heard by the county’s Board of Equalization.

One attendee from the East 23rd Street PAC angrily addressed the spike noting it was a “rape of the low income taxpayer” and asked Lombardi what governing entity needed to be marched upon.

Midtown resident and Independence Plaza property owner expressed the same sentiment and showed a tax levy increase of over 1900 percent on a vacant parcel of land that sits in the 1300 block of E. 42nd street.

“The process is a travesty and specifically targets lower income taxpayers. The process at which these amounts were arrived at is arbitrary at best and extremely flawed from the very beginning,” they said.

Jackson County Legislator Ron Finlay was on hand and addressed concerns from neighbors who were outraged and talked of organizing a march on the county legislature in response to the hefty assessment hikes.

“I’m not going to try and tell you shouldn’t be upset or that you should not take civil disobedience or whatever you feel is appropriate,” said Finlay. “The main thing I’m trying to get out is that you have certain appeal rights and there’s certain information that you should be prepared to submit in the appeal process.”

When asked if the county legislature would reconsider the process, Finlay indicated he wasn’t sure that was under the purview of the county legislature and passed the responsibility for the assessment on to the taxing entities such as the Kansas City Public Schools.

“As I understand it, the Kansas City School District has not been able to increase their levy for many, many years, so what’s happening, of course, is the assessed values are being impacted,” said Finlay.

He encouraged attendees to pursue the appeal process and indicated that the county legislature would be pushing at the state level for relief.

The Lykins neighborhood is sponsoring another seminar at the Northeast Kansas City Chamber of Commerce offices this Saturday, June 22, at 4 p.m.

If you are interested in learning the appeals process, RSVP to Gregg Lombardi at 816-401-1951.

Lombardi indicated that spaces are filling fast given the impending first deadline of Monday June 24.