By Joe Jarosz

Northeast News

July 30, 2014

KANSAS CITY, Missouri – When the city began talking about building a streetcar in Brookside, Sherry DeJanes started listening.

When city officials considered laying the streetcar tracks behind her home along a community trail, her interest grew and she began to take action.

Now, she’s making sure everyone eligible to vote in the Aug. 5, primary election fully understands what they’re voting for, even if she doesn’t quite understand it.

“I have a law degree and I can barely make it through it,” DeJanes quipped about the wording for Question A, also known as Phase II of the Transportation Development District (TDD).

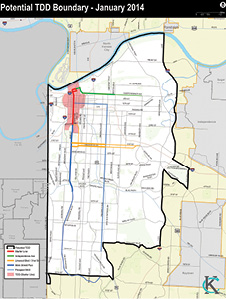

Phase II calls for service lines along Independence Ave. from downtown to Benton Boulevard, Linwood Boulevard to Prospect Avenue and Main Street to the campus of the University of Kansas City-Missouri. Funding for the three routes shall be done in conjunction with the capital funding for the Prospect MAX route, including local, state and federal funding means.

“The funding mechanisms are inherently unfair and burdensome to a population in Kansas City that can least afford it,” DeJanes said.

DeJanes, who started the website www.besmartkc.com, said the goal of the group is three pronged. First, concerning the funding mechanisms, from analysis she’s conducted, for the population east from Troost to Prospect, the median income is under $15,000. West from Troost to Main Street, and along the Independence Avenue route, the median income is between $15,000 and $25,000.

“That regressive tax that is only going to burden the transportation development district only seems inherently unfair,” DeJanes said. “Then if you take a look at the special assessment [tax] that will burden families within a third of a mile of the route and based on my research, there is no consistent conclusion reached that they’re going to have any appreciation in value and that’s what it’s based on.”

In the final report filed by the NextRail consultants, DeJanes pointed out that in the initial summary, the streetcar will benefit the “entire city.”

“Well if it’s going to benefit the entire city, then why not have it paid for by the entire city?” DeJanes asked. “If you’re going to have a sales tax, impose it across the board.”

The special assessment tax, she points out, is also a burden to nonprofit organizations. Redemptorist Church, one of the respondents in the judicial hearing, is located at Linwood and Broadway. With the assessment tax, DeJanes said the church will have to pay $4,392 every year for the next 25 years. The church supports a social service center that provides rent and utility assistance, food and clothing assistance and is only charged $1 a year for rent.

“The pastor of that church testified that paying that tax is going to require them to examine whether or not they’ll have to curtail or completely eliminate certain services,” DeJanes said.

The third prong, DeJanes noted, is that the city has so many other needs for the current infrastructure “that it seems ridiculous to me that we’d develop a completely new infrastructure that is going to divert funds from what we already have and the needs that already exist.”

She said the group starts with those three points, but also touches on other fallacies, for example 16 million jobs created – “only to be created in the construction sector” – the inflating percent of the sales tax being generated from the Country Club Plaza, the Crown Center and the stadiums and the idea that people won’t be burdened by this.

“Along the Linwood line, the special assessment for individual residential homes is between $2.27 and 47 cents,” DeJanes said. “But there are lots of rental properties that are assessed at a high value and will have to be passed on to the people who rent them.”

The goal is to have the measure voted down in August. If it gets voted through, DeJanes said they’ll keep doing what they’re doing, but emphasizing more on the sales tax. Foremost, however, the group is not against public transit. The group believes the city can retool what it already has in the bus system to make it more responsive and efficient and more attractive.

“We can equip them with WiFi, sound system, plug-ins so people can charge their devices,” DeJanes said. “We can deploy smaller buses along the routes that have been closed after 6 p.m. There are many things we believe that can be done.”