By Paul Thompson

Northeast News

December 14, 2016

KANSAS CITY, Missouri – What’s the best way to get 57% of Kansas City voters to support a property tax hike that would finance $800 million in needed infrastructure improvements?

That’s the question Council members asked themselves on Wednesday, December 7, as City Manager Troy Schulte and KCMO Deputy Director of Finance Tammy Queen appeared before the joint Finance and Governance and Transportation and Infrastructure committees to discuss a potential $800 million General Obligation Bond, which would be subject to a citywide vote on the April 4, 2017 ballot.

The G.O. Bond would prioritize shovel-ready infrastructure projects related to streets, bridges, sidewalks, flood control, parks and public buildings. Other priorities are projects currently included in the city’s five-year plan, those that leverage federal grant and/or private investment, and those that address public safety. Examples of potential projects in the Northeast – based on a preliminary list put together by city staff – include $6.3 million in funding for Paseo Gateway improvements and $7 million for the restoration of Corinthian Hall at the Kansas City Museum.

The restoration of Corinthian Hall certainly fits the mold for inclusion among the G.O. Bond projects. Kansas City Museum Executive Director Anna Marie Tutera spoke with the Northeast News after the potential bond issue was first presented to the City Council during a Nov. 10 work session. She confirmed that the restoration will utilize significant private investment, and that the project will soon be shovel-ready.

“By the end of this calendar year, we will be hiring our construction team. The construction team will start doing pre-construction with the architects,” said Tutera at the time. “Because we’ve spent the past 20 months doing so much design planning and institutional planning, we really will be shovel-ready in the spring. We will be ready to start construction.”

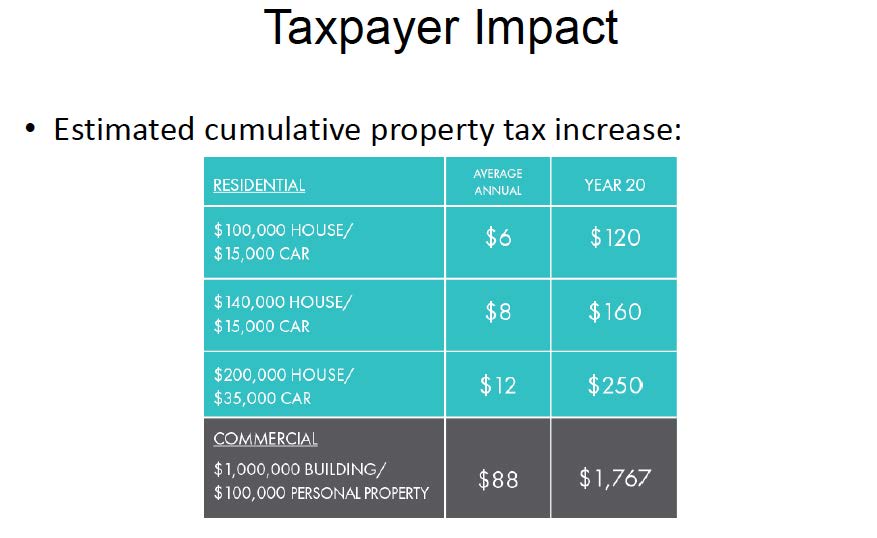

If the bond is approved, property taxes would increase incrementally over its 20-year life. As presently constructed, the average annual increase for a $100,000 house would be $6 per year, reaching a high-water mark of $120 by year 20. Schulte noted one benefit of the General Obligation Bond, which the city has proposed spending in $40 million annual increments, is that it could be renewed without an additional increase in property taxes after the term is complete.

“It gives you a chance to create a self-sustaining capital improvements program,” said Schulte.

Still, there are roadblocks to approving any property tax increases. As of April 30, 2016, the city was already on the hook for $2.576 billion in debt. Furthermore, some City Council members have expressed uncertainty as to whether their constituents would support a bond issue without a specific list of projects. During the Dec. 7 joint committee, Schulte and Queen’s presentation included only examples of possible projects.

2nd District Councilman Dan Fowler articulated during the committee meeting that residents of his district are worried they won’t receive equal consideration without a firm strategic plan in place.

“I know my constituents are very concerned with coming up with some kind of system where they can be assured a fair share,” said Fowler. “I would rather my constituents show up and vote for this, rather than vote against it.”

4th District Councilwoman Katheryn Shields expressed similar concerns, specifically citing her desire to present a concrete plan to the city’s taxpayers in April.

“We ought to be basing our decisions on a definite strategic plan,” said Shields.

Schulte responded that the city has hired a consultant to help prioritize a project list. The KCMO City Manager also reiterated that the city’s infrastructure concerns aren’t going to disappear if the city keeps kicking the can down the road.

“One thing we do know is that we need resources,” Schulte said. “In a few years, the majority of our roads are going to be in poor or failing condition without an infusion of resources.”

1st District Councilman Scott Wagner acknowledged another potential problem with issuing a strict bond plan too early in the process, noting that the consultant’s recommendations weren’t expected to be completed for another couple of months. If the bond issue is to make it onto the April ballot, the ordinance must be passed and turned into the Board of Election Commissioners along with a notice of election by January 24, 2017. The final Council meeting before that deadline will be on January 19.

“I would note that our disadvantage here is time,” said Wagner. “We have a little over 30 days to put this out.”

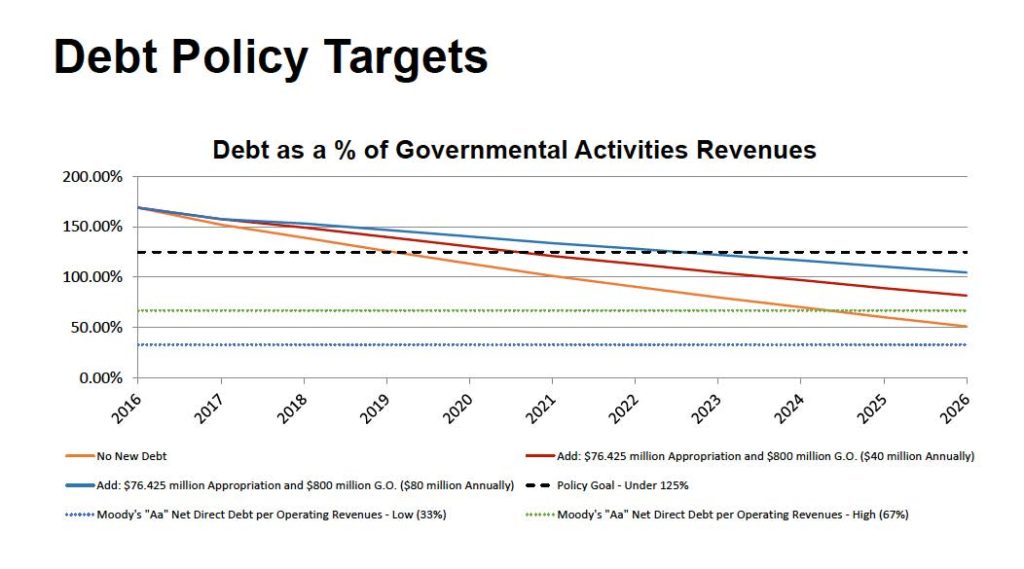

In addition to calls for a more specific plan, a sizable portion of the joint committee meeting was spent discussing debt. Queen and Schulte both acknowledged that Kansas City is highly leveraged, though the city’s General Obligation Credit rating remains at ‘AA’ according to Standard & Poor’s and ‘Aa2’ according to Moody’s. Queen noted that factors like the city’s management and institutional framework help offset the negative marks caused by Kansas City’s high debt ratio and comparatively small tax base for a city of its area.

As of today, the City of Kansas City, Missouri is short of its primary debt issuance targets, which are: less than 14.5% debt service as a percent of revenues (just under 16% before G.O. Bond), less than 125% outstanding debt as a percent of revenues (roughly 175% before G.O Bond), and less than 4.5% outstanding debt as a percent of full value of property (over 5% before G.O. Bond).

But even though Kansas City is well above recommended debt ratios for a city of its size, Queen said that those non-financial factors combined with evidence that the city can still make its debt service payments should still make an $800 million G.O. Bond a feasible undertaking. Schulte concurred.

“What Tammy’s articulating is, we’ve got to show that our aggregate debt levels are retreating,” said Schulte.

While that can still be the case if voters approve the bond issue, the city’s debt policy goals could remain unattainable for the better part of a decade. At one point during the discussion, Councilwoman Shields wondered why a dedicated property tax increase wouldn’t be a slam dunk proposition from the perspective of the credit agencies.

“If we had no other debt and we were within some of these targets, then you’re absolutely correct; this is the best kind of debt,” Queen responded. “The issue becomes that we are so highly leveraged that they are watching everything that we do.”

Before wrapping up the meeting, Councilman Wagner outlined key areas for the joint committee to consider before their follow-up meeting on December 15: 1) What level of flexibility versus certainty do they want?; 2) systems approaches versus projects; and 3) Is the potential project list provided by city staff a good list?

The joint committee will pick up their discussion about the $800 million General Obligation bond at 9:30 a.m. on Thursday, December 15, on the 26th floor of City Hall. If you can’t make that meeting, KCMO officials also urge the public to provide feedback at kcmomentum.org, which is the city’s virtual town hall.