By Abby Hoover

Central Bank of Kansas City (CBKC), which has served Northeast for 70 years, is focused on improving its community and the lives of its customers, starting with the youngest generation.

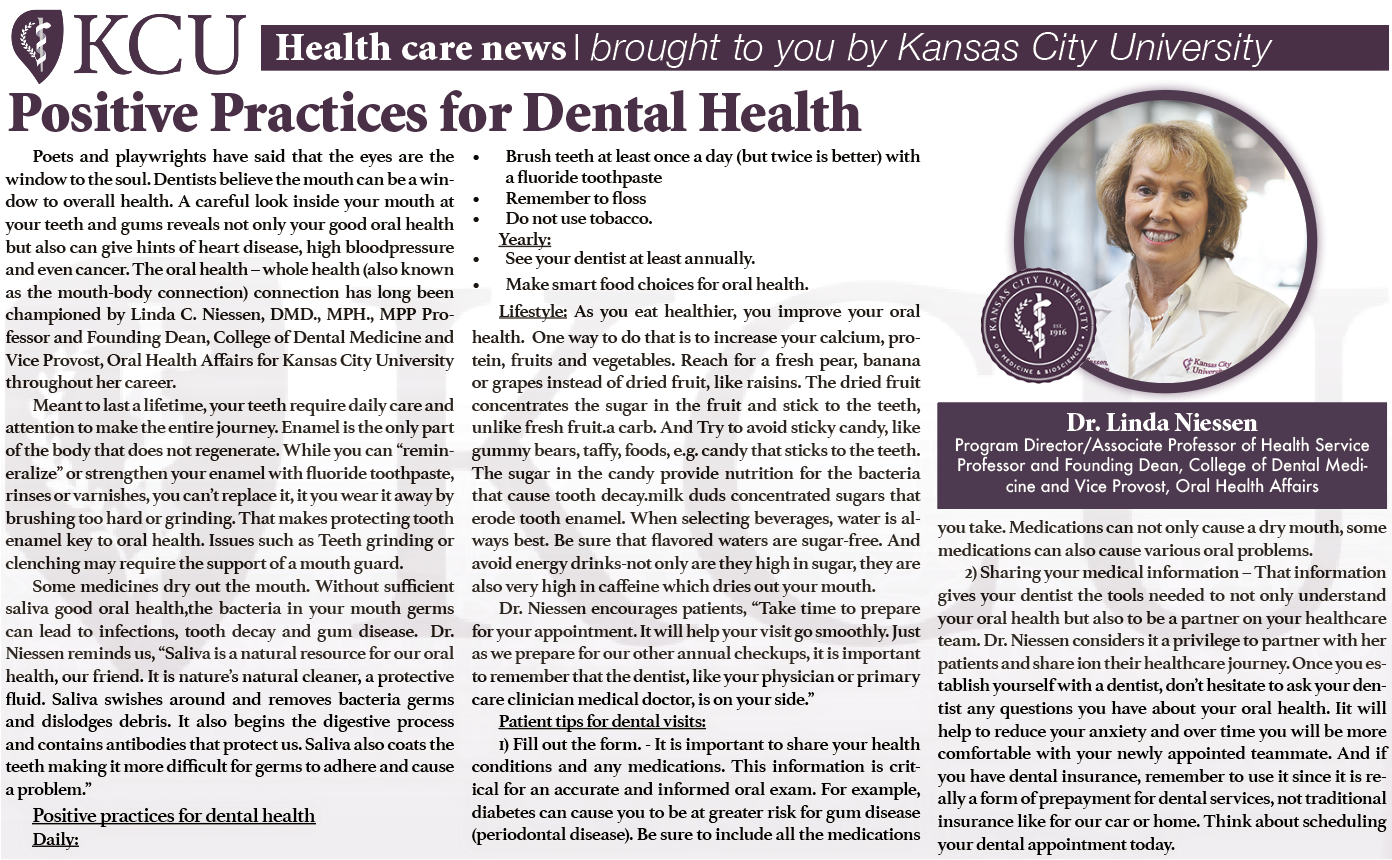

Sarah Cousineau, Vice President of Marketing and Community Impact at CBKC, is teaming up with local schools to start teaching students financial education as early as first grade.

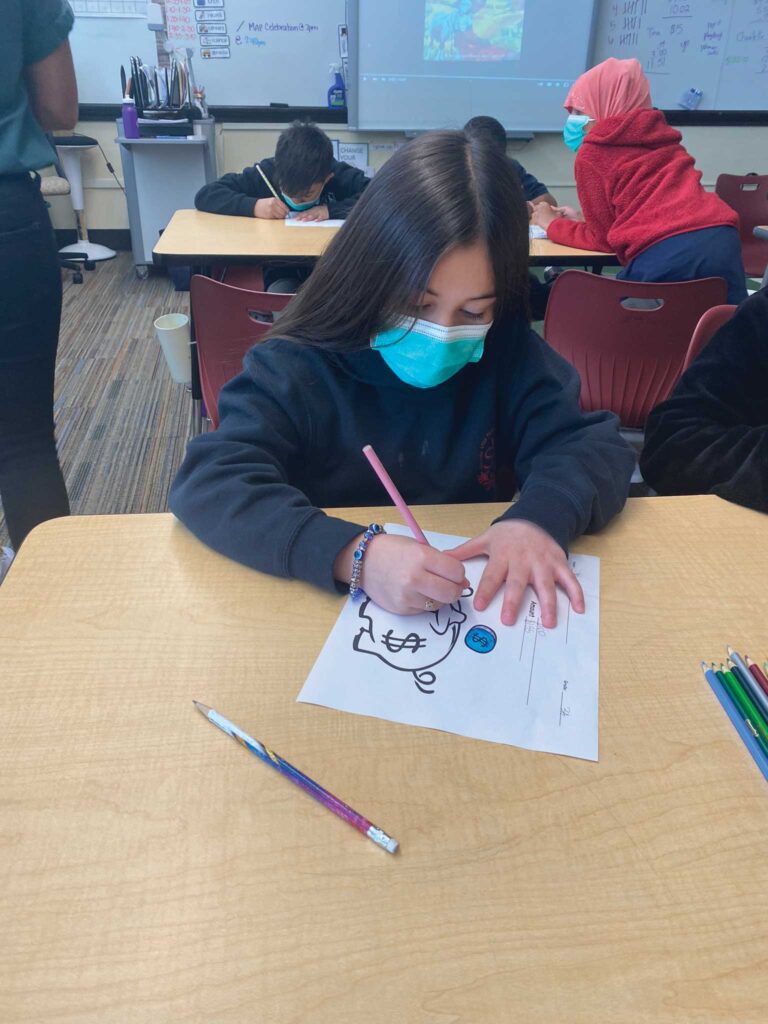

Students at Scuola Vita Nuova and Garfield Elementary, both within walking distance to Central Bank, learned about saving for their future, both long- and short-term goals, through children’s books like “Beatrice’s Goat.” Students listen to a story about Beatrice, a little girl from Uganda who receives a goat, and the impact of that goat on her family. They learn what it means to save and use estimation to decide whether or not four people have enough money to reach their individual savings goals. They also work through a set of problems requiring them to identify how much additional money must be saved to reach given savings goals. Students learn what opportunity cost is and identify the opportunity costs of savings decisions made by Beatrice and her family.

“I had to kind of reel them back in when they were working on their own savings goals – some of them are saving for lamborghinis – and we talked about the importance of making realistic goals so they don’t feel discouraged,” Cousineau said. “A lot of kids are saving for phones or AirPods, one girl was saving for college and another wanted to save for their brother to get a car.”

On May 26th, 35 Garfield Elementary students visited CBKC for a tour and financial education activities.

“They asked some really good questions,” Cousineau said. “We started with a tour of the teller area, given by our VP of Operations, Polly Heishman, so they could see how we serve our customers. They were really fascinated by the process and machinery used to manage deposits and withdrawals. “

The fifth graders prepared questions for Steve Giles, President and CEO of CBKC, about his career path in banking and also had questions about why people put their money in banks. Keeping your money in a bank gives you safety, convenience and the possibility of earning interest – those were a few of the reasons that Mr. Giles shared with the students.

CBKC is setting up future generations for financial success, but its staff understands that the community also needs assistance now. With local and federal partners, the bank is working to improve living conditions in the Northeast.

Earlier this spring, U.S. Representative Emanuel Cleaver, II, Chairman of the Financial Services Subcommittee on Housing, invited constituents and other civic leaders to CBKC on Independence Avenue to announce a $3 million grant for Community Project Funding to help provide affordable housing in some of Kansas City’s low-income neighborhoods.

The funding, administered through the local LISC office, will also provide down payment assistance and minor home repair through Local Initiatives Support Corporation (LISC), the Mid America Regional Council (MARC) and other local stakeholders such as Central Bank.

Central Bank of Kansas City, a Community Development Financial Institution (CDFI) since 1998, works with the U.S. Treasury, which joins federal money with private sector capital to fund market-driven solutions to community-based issues. CDFIs work within its own local sector to help inject new sources of capital into areas and neighborhoods that normally would lack access to investment.

Giles is excited to work with partners like LISC and MARC to continue to provide affordable housing in the Northeast community.

“We provided them a list of projects that we’ve already done, mostly in the Lykins neighborhood,” Giles said. “We’ve financed about 10 houses working together with the Lykins Neighborhood Trust and we’ve worked with some private developers too on homes in the 3200 block of east 7th Street.”

Funding will be spent primarily in two local zip codes, 64123 and 64124 and groundbreaking on the projects should take place in about six months, according to Geoff Jolley, Director of LISC KC.

The Regional Housing Initiative is one of ten community projects championed by Congressman Cleaver which will directly benefit residents of the Fifth Congressional District.

“I’ve said it many times before – having a roof over your head, a place to call home, and a sense of community is central to your somebodiness,” said Congressman Cleaver. “This federal investment will increase access to affordable housing and programming that makes home ownership achievable for individuals and families throughout the region.”

Central Bank of Kansas City at 2301 Independence Blvd., is open from 9 a.m. to 5 p.m. Monday through Friday (til 6pm in drive-thru), 9 a.m. to noon on Saturdays, and 24 hours a day at centralbankkc.com.