The Board of Equalization has postponed the consideration of a proposal that would cap the increase in property tax increases.

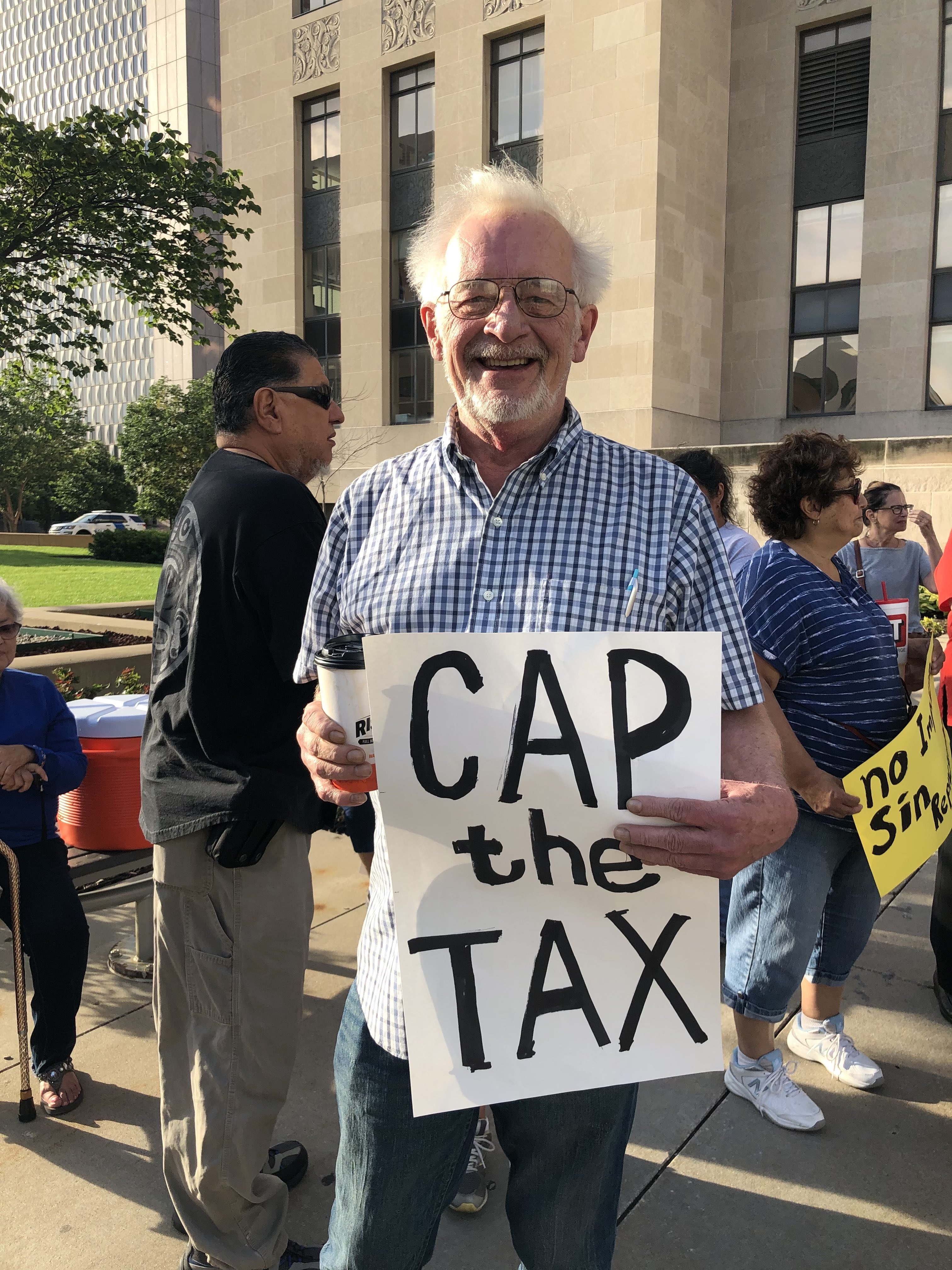

Residents gathered this morning outside the Jackson County Courthouse to protest the recent hikes in property taxes.

People held signs that said “Cap the Tax” and “Frank White still trying to steal home(s).”

Robert Ontman, president of Lykins Neighbhorhood Association, was in attendance and said this issue is not just for property owners, but touches everybody.

“If it goes through, it’s going to be passed on to renters, it’s affecting investors, it’s affecting development, it’s affecting everybody,” he said. “We are out here to let our elected officials know that they cannot operate in such an uncontrolled and bad manner.”

Sam Crowley, a Lykins resident, discussed the issue of affordable housing.

“The Northeast has a lot of people who are lower income and middle income and they simply just cannot afford to pay a sharply higher property tax,” said Crowley. “A big issue these days is this notion of affordable housing. This runs a little bit contrary to that effort to make houses affordable.”

Inside the courthouse, residents packed into the Legislative Chambers on the second floor to hear the outcome.

Preston Smith, a Board of Equalization representative with the Blue Springs School District, offered a proposal for intercounty equalization order that would cap the valuation increases.

Under this proposal, property values that increased by more than 200 percent would see an increase of 14 percent. Values that increased between 100 and 200 percent would see an increase of 13 percent, and those who had an increase between 12 and 100 percent would have increases set at 12 percent. Those who saw less than 12 percent increase would not see any changes.

In a July 8, 2019 press release from the office of Jackson County Executive Frank White, who supports County Assessor Gail McCann Beatty, White spoke out against Smith’s proposal.

“The County remains committed to ensuring that the assessment process is both fair and accurate. The proposal discussed at today’s Board of Equalization’s (BOE) meeting proposes to set arbitrary caps on valuation increases, regardless of the property’s true value. However, state law requires the BOE, like the County Assessor, ensure properties are assessed at their true value.”

In a memo from Smith to Melinda Talyor, Board of Equalization Clerk, Smith said “during the last few weeks, we have seen instances where the County Assessor’s numbers are inaccurate, inconsistent, and wildly inflated. Many of these problems could have been corrected if a physical inspection had occurred.”

During his presentation, Smith outlined how he believes the assessments have targeted lower income areas.

During his presentation, Smith outlined how he believes the assessments have targeted lower income areas.

“We have so many cases where properties were arbitrarily assigned a value,” he said. “The poorest area of our city were disproportionately targeted. In the poorest areas we had the largest increase and in the wealthiest area we had the smallest increase. It’s arbitrary and inconsistent. Inspections did not happen. There is so much about this assessment that is a total mess. I’m asking you to offer a motion to fix this. It took too much to get here. There is no plan B. It’s a black and white issue.”

Ultimately, the BOE said that his proposal was incomplete and game Smith ten days to present further information.

“The County Counselor or the County Executive’s office had four areas listed as to why your proposal should not be accepted,” said Marilyn Shapiro, vice chair of the BOE. “I would like to ses from you a response as to why it should be. One of the areas they listed was the ratio letter that had been received.”

“If we are talking ratios,” Smith said, “I think the ratios have been wrong for a while. I’m not going to have somebody that doesn’t know beans about data comparing my data to theirs. I’m not accusing you of not knowing the data, I’m accusing the county of not knowing the data.”

Shapiro said she would also be asking for information from the Jackson County Assessment office.

“I have never seen a complete, written methodology from the assessment office. I have never seen the maintenance report, which was apparently submitted to the state,” she said. “There are other documents that I believe we as a board need to see and have the right to see. And I believe there are certain witnesses we need to have at that meeting from the assessment department, from the County Counselor’s office, and from the County Executive’s office.

Christopher Smith, chairman of the BOE, said the consideration would be postponed to ensure they receive ample information.

“…we need more information because the impact of this proposal could be far-reaching and we want to make sure that we are well-versed in what that impact could be. Once again, we are committed to doing what we were appointed to do. We take it very seriously. We care. We are going to do what’s right, fair, and lawful.

He continued by discussing information delivered by local media.

“I have noticed that there is lots of information out there on TV and in newspaper that is simply not correct,” he said. “This morning on KCTV5, Gina Bullard said we were going to take a vote on this today. Where did she hear that? Who told her that? Anything that you’ve heard about that we want to do, unless it came from me, you should take it with a grain of salt, because it might not be true, and if you believe something that’s not true, it’s only going to add to the confusion and anger and frustrations already out there. Do you believe everything you see in the newspaper? Do you believe everything you see on TV?”

One audience member spoke up and said “Don’t patronize us.”

Gregg Lombardi, former Legal Aid attorney, said he was not sure what the County Assessor’s office would provide in terms of the ‘how’ when valuing property.

“I don’t think that the county can come up with that,” he said. “If you go through and pick properties at random and you look at the numbers, the numbers are completely all over the board. Brand new, beautiful houses… their assessments went down. Two vacant lots right next to each other… one stayed the same, one went up 1000 percent. There are totally all over the board. There is no rhyme or reason to what they did so I think they are going to have a very hard time explaining that, other than to just say ‘you need to just trust us,’ which I think, given the numbers that have come out, they don’t seem to be trustworthy.”

Christopher Smith closed the meeting by assuring attendees that the BOE will hear every appeal.

“At this point in time, we intend to hear each and every appeal that is timely filed — no matter how long it takes,” he said. “Each taxpayer will get an audience with us.”

Addressing the attendee in the room who spoke out previously he said “We are, whatever you think ma’am, on your side. However I come across, I apologize if I offended anybody. The board was set up to take care of this exact situation that has come before us and that is what we are going to do.”

There remains a July 29, 2019 deadline to file a formal appeal to the Board of Equalization. To contact the Board of Equalization, their information is below:

Website: www.jacksongov.org/330/Board-of-Equalization

Email: boardofequalization@jacksongov.org

Phone: 816-881-3309

Jackson County Courthouse: 415 E. 12th Street, 1st Floor, Kansas City, MO 64106

Comments are closed.