Abby Hoover

Managing Editor

This week, Kansas City Public Schools (KCPS) shared a report of the staggering impact tax abatements have had on the district, pushing for incentive reform.

In 2019, more than $164 million of tax revenues were abated or redirected within Kansas City, Mo. Of that, $30 million were abated from KCPS and in-district charter schools.

Overall, $45 million was abated from all the city’s school districts in 2019 – including Grandview C-4, Hickman Mills, Center, North Kansas City, Park Hill, Raytown and Platte R-3 school districts – by the city of Kansas City, Mo.

In Kansas City, there are seven different programs that grant tax incentives: Tax Increment Financing (TIF), Enhanced Enterprise Zone (EEZ), Chapter 353 Tax Abatement (353), Chapter 100 Sales Tax Exemption (Ch100), Planned Industrial Expansion Authority (PIEA), PortKC and Land Clearance for Redevelopment Authority (LCRA). The City Council has the final say over what incentives will be granted for four of the programs – TIF, EEZ, 353 and Ch100. For the others – PIEA, PortKC and LCRA – a non-elected board appointed by the mayor grants the incentives.

“In many cases, these mayoral-appointed boards have granted up to 25 years of tax abatement even when the affected school district and other taxing entities (libraries, mental health fund, counties, et cetera) voice concerns or oppose the requested incentive level,” according to the report. “KCPS and other school districts have zero authority over decisions to grant property tax abatements.”

Kansas City, Mo. grants longer terms of tax incentives at higher levels – up to 75 to 100 % – than most peer communities. For the district, this raises concerns that the City is over-incentivising many projects, thereby diverting critical resources away from schools, libraries, infrastructure and other public services.

“For example, if [Kansas City, Mo.] granted a business 25 years of property tax abatement to construct a new building, but it really only needed 15 years of abatement in order to make the project financially feasible, this means that schools, libraries and other public entities missed out on 10 years of tax revenues that could have helped fund school renovations, teacher salaries, mental health services, et cetera,” the report said. “Now think about this issue multiplied by hundreds of projects over the years.”

KCPS is ranked 17 among 5,600 school districts in the level of abated property tax revenue.

According to the district, KCPS buildings need $400 million of deferred maintenance. Over the last three years, $80 million in tax incentives has been abated from KCPS and charter schools.

“Tax incentives can be a valuable tool for cities and states to attract and grow businesses and to promote redevelopment in distressed neighborhoods,” according to the district. “However, without proper controls and oversights, they can also be harmful to communities due to the loss of potential public revenues.”

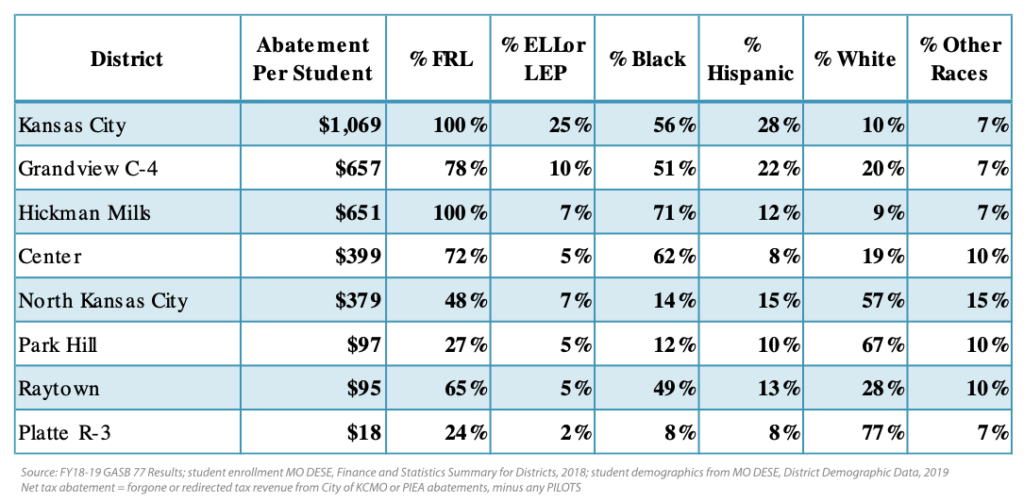

KCPS experienced the highest net tax abatement per student of all Kansas City, Mo. school districts in 2018-19 at $1,069.

The data shows that urban school districts see their dollars abated at a higher level per student than suburban districts do, although within KCPS boundaries, the majority of projects receiving incentives have been in non-distressed areas. In addition, 92% of the abated property values within KCPS boundaries are west of Troost.

According to data from 2018-19 school year enrollment data from the Missouri Department of Elementary and Secondary Education (DESE), the number of non-white students a school has shows correlation with the abatement per student.

“KCPS and other taxing jurisdictions south of the river are not consulted in a meaningful way in evaluating incentive requests,” according to the district. “Conversely, Northland school districts are often brought to the table during negotiations. This often results in Northland Districts being able to secure lower incentive levels and/or higher payments for schools.”

Park Hill School District’s payments from developers, like PILOTs, were nearly 40% of the abatement level and North Kansas City School District’s payments from developers were more than 10% of the abatement level. For KCPS, it is only 4.5%, and for Hickman Mills, it is only 2.2%.

Additionally, for every $100 of abated taxes, the district calculated that Park Hill schools receive around $40 and North Kansas City schools receive around $10. KCPS and in-district charters receive around $4.50 and Hickman Mills receive around $2.20.

Prior to the City Council’s vote on whether to extend a 20-year 100% tax abatement incentive package for BlueScope, a billion-dollar multinational corporation for 13 more years, KCPS Superintendent Mark Bedell called the over-saturation of incentives systemic racism.

“Members of the City Council, as well as business leaders, have stood up in the recent weeks to say Black Lives Matter,” Bedell wrote in June of 2020. “I commend them for doing so, but as the adage goes, actions speak louder than words. If Black Lives Matter to you, then so should the schools south of the river.”

Bedell noted that public school funding is constantly under attack, but even through the pandemic, the school supplied multiple meals a day for all Kansas City kids in need, sourced technology for students, offered trauma-informed support, and secured resources for families dealing with homelessness.

In August of 2019, Kansas City Public Schools submitted a letter with incentive reform recommendations to the current City Council. The group of school districts from the Greater Kansas City area, including KCPS, identified several key incentive reforms that they recommend to “bring accountability, transparency and greater equity to economic development” in Kansas City, Mo.

The recommendations include the ability for school districts and non-city taxing entities to opt in on projects seeking incentives in excess of 10 years at 50%, ensuring a consistent and equitable process for all school districts, and implementing targeted efforts to address barriers to eastside development. They say these reforms should apply to all incentive programs.

While KCPS stated the district does not oppose the use of incentives when they are used appropriately, they do want to make sure that school districts and other taxing entities are included in the decision making that has such a heavy impact on tax revenues.

Across the state line in Kansas, school districts have to sign on to TIF plans. Ohio school districts have to approve TIFs over 10 years at 75%. In Louisiana, school districts and other taxing jurisdictions must opt in for incentives to be granted through their largest incentive program. California school district revenues are not impacted by Enhanced Infrastructure Financing Districts. In Minnesota, two of three taxing jurisdictions – city, county and school district – must approve plans that last longer than 15 years. Other comparable cities like Indianapolis, Chicago, Tulsa, San Antonio, Philadelphia, Omaha and Des Moines grant shorter abatement terms.

Councilwomen Ryana Parks-Shaw, Andrea Bough and Melissa Robinson hosted a virtual community forum on Saturday, Oct. 24 at 9 a.m. via Facebook Live.

There will be a committee hearing on Wednesday, Oct. 28 at 1:30 p.m. in the Council Chambers on the 26th floor of City Hall. Members of the public who want to participate in public comment are welcome to submit email testimony to the City Clerk at publictestimony@kcmo.org, join via Zoom or to attend in-person.